Improvements to Benefits and Deductions

We’re working hard to make Payroll by Wave easier to use, and faster. One of our most recent improvements is on the Benefits and Deductions screen. Let me show you what’s new!

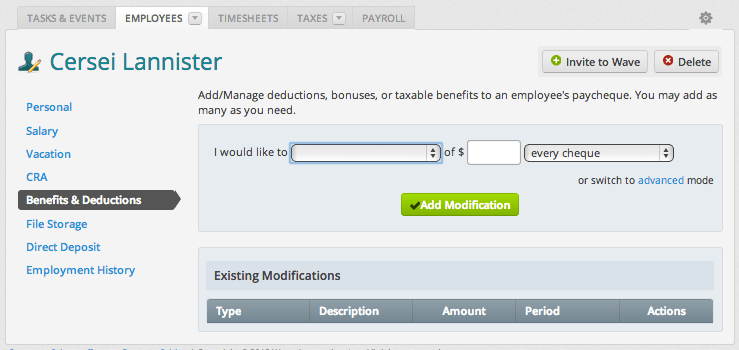

Before we made this change, the Benefits and Deductions page looked like this:

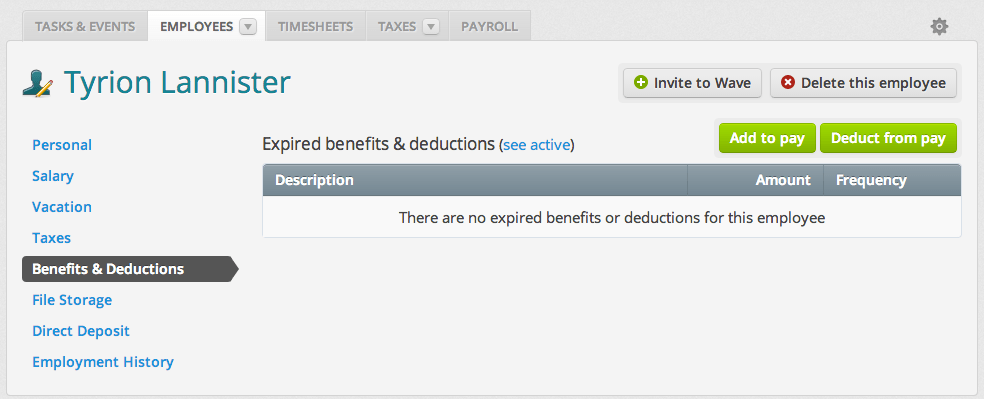

To improve the experience, we have separated additions and deductions to their own screens. To navigate to them, simply click the Add to pay or Deduct from pay buttons. The new look of this screen is below:

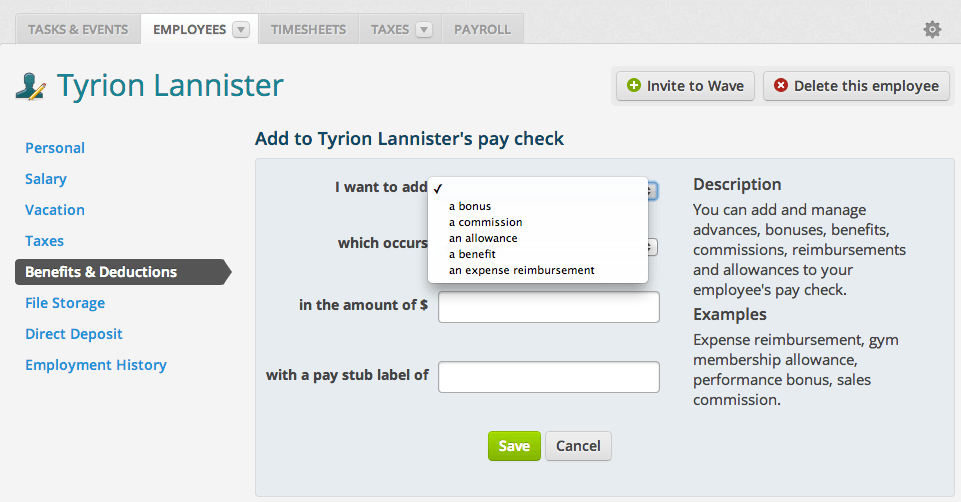

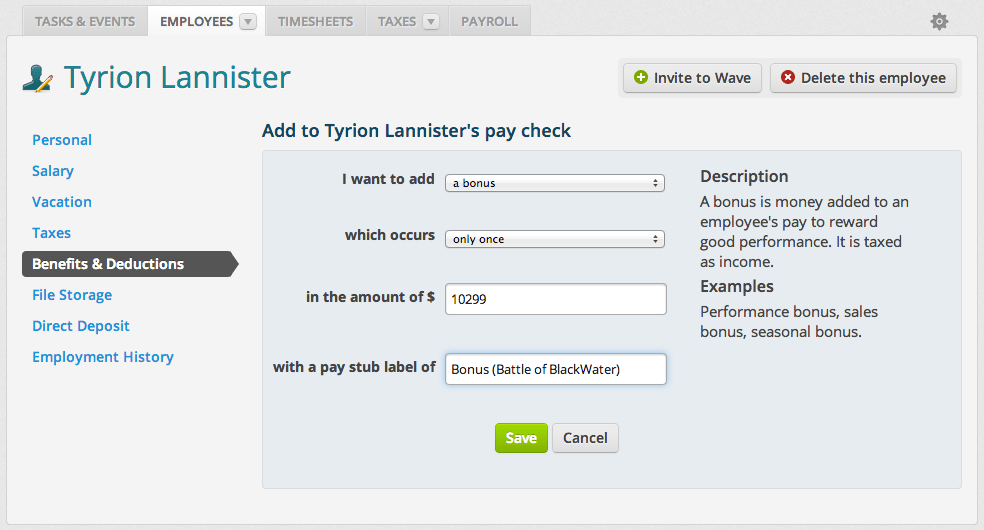

When you click the new Add to pay button you will be taken to a screen that looks like this:

From here you will be able to select the type of benefit you’d like to add to Tyrion’s paycheck, a bonus for example. You could also add a commission, an allowance, a benefit or an expense reimbursement. Here you can edit the frequency, the amount, and the label you’d like to show up on your employee’s pay stub.

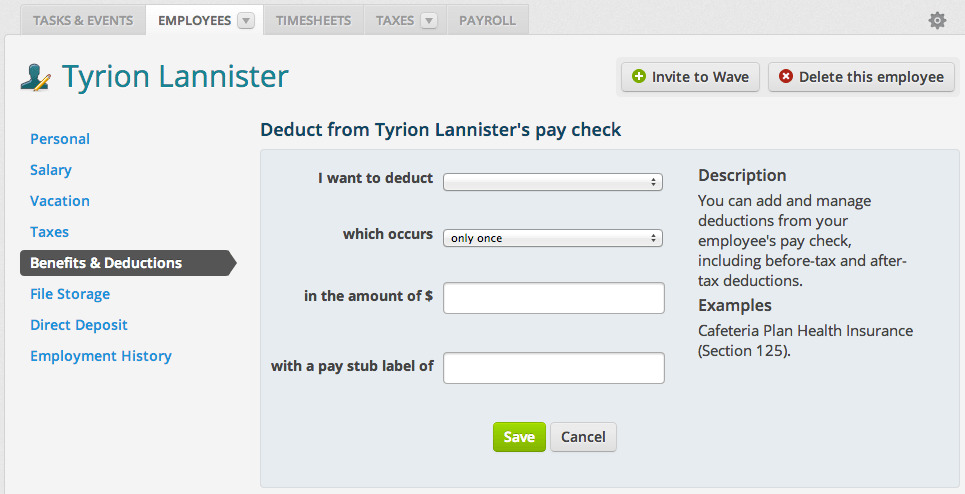

The new deductions page looks similar the the additions page, but with different selection options:

The drop-down options will change based on if you are in Canada or the U.S. You will be able to edit the frequency, the amount and the label the same way you are able to on the Benefits page.

You may notice that we have removed the Advanced mode option. Don’t worry, the new design allows you to perform all of the same tasks as you could with the Advanced mode.

If you have any feedback on our design changes, we’d love to hear it. Feel free to reach out to our team at support@wavepayroll.com!

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.