Survey Results: The Cloud Has Won

For accountants and bookkeepers in the Wave Pro Network

Just how important is the cloud to small business owners today? Is it a “nice to have”? Is it essential to small business? We wanted to know, so we surveyed some customers about their use of cloud technology.

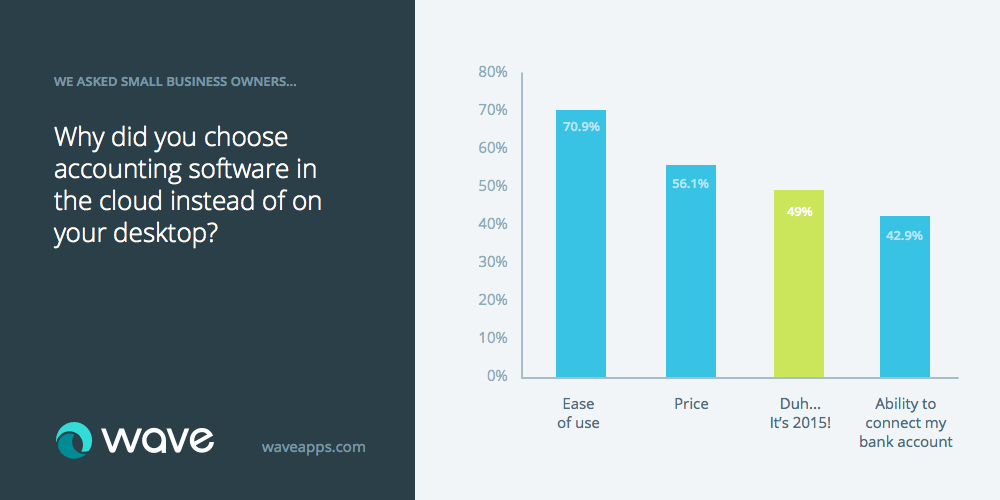

First up, we asked them, “Why did you choose accounting software in the cloud instead of on your desktop?”

Consistent with what people have said for a long time about the cloud, the top two reasons were ease of use and price (selected by 70.9% and 56.1% of respondents, respectively).

The next most popular response was the interesting one: 49% said, “Duh, it’s 2015.”

What a telling statistic. Like a teenager rolling his or her eyes, nearly half of small business owners surveyed are basically telling us that the conversation around the cloud has finished. For business owners already using the cloud, the decision is beyond obvious, and going back to installed software is a non-possibility. The cloud has won.

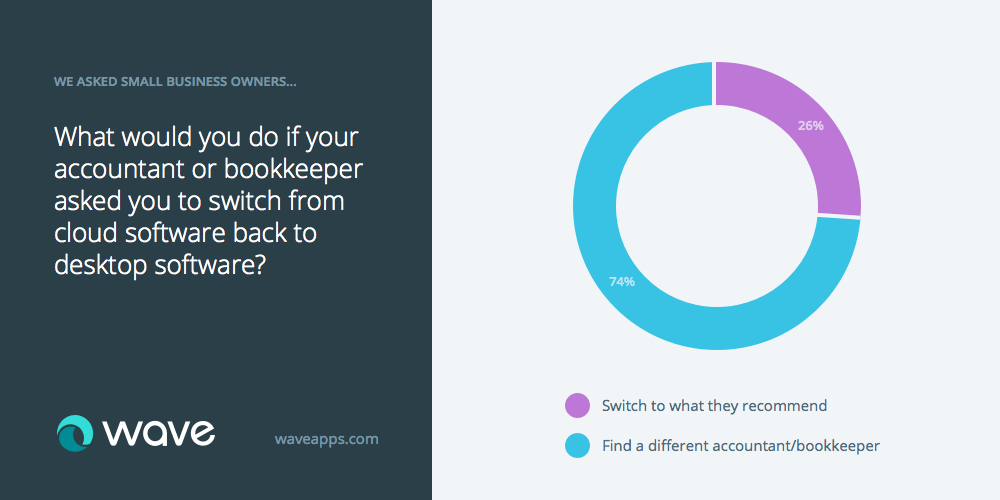

We followed up that question by asking, “What would you do if your accountant or bookkeeper wanted you to switch back to desktop software?”

A staggering 74% said they would rather find a new accounting professional than revert to installed software.

We can speculate as to the reasons why:

- the business owner doesn’t want to forego the economy and ease of use of the cloud

- the business owner has a strong product preference to the solution they’re using (Wave, of course, in this case), and doesn’t want to leave it

- maybe the business owner is judging the accounting professional’s overall skill by their ability to adopt current technology: Maybe “I’m not in the cloud yet” is for them equivalent to “I’m out of touch with my profession.”

Regardless of the reason, the strength of this response is remarkable. If you want to put an end to your accounting practice, just tell your customers that you won’t work in the cloud.

More survey outcomes

Since these respondents are so committed to cloud accounting, they must be digital natives, right, doing everything online? Not so fast.

On the question, “Where would you look to find your next accounting professional?” the responses were decidedly old-school:

- 79.5% said “Ask friends directly”

- 45.7% said “Google”

- 30.3% said “Social media”

- only 26.2% said, “Local review sites” like Yelp or Angie’s List.

So as it’s always been, you’ll grow your practice best by getting good word of mouth from your customers. But I suggest you don’t neglect the digital channels: Remember that a prospective customer will probably Google you and look for reviews, after they hear about you from a friend, to validate the recommendation.

On the question, “How do you want to interact with your accounting professional?”:

- 47.5% said “Email”

- 26.2% preferred “In person”

- only 14.5% wanted a “Virtual meeting” (like Skype)

- and even fewer (11.8%) wanted to connect by phone

In summary: Today’s small business owners don’t necessarily want to do everything online. But when it comes to accounting software selections for 2016, the cloud has moved beyond “should I / shouldn’t I” conversations. For those who have gone there already, they’re not going back. And given that Wave signs up 10,000 new businesses a week, that means more and more business owners are moving to cloud accounting, with no intention of switching back to installed software.

___

A couple of notes:

- The survey was conducted in September 2015, with a sample size of 1,026.

- The wording “Duh, it’s 2015” is the actual wording used in the multiple choice survey answer. This is not a paraphrase. And it pre-dated Justin Trudeau’s similar answer by more than a month.r

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.