Year-end T4 filings have never been simpler

Feeling like there are not enough hours in the day this time of year? We know how busy year-end is for small business owners. We’re excited to announce a number of improvements to the year-end filing process.

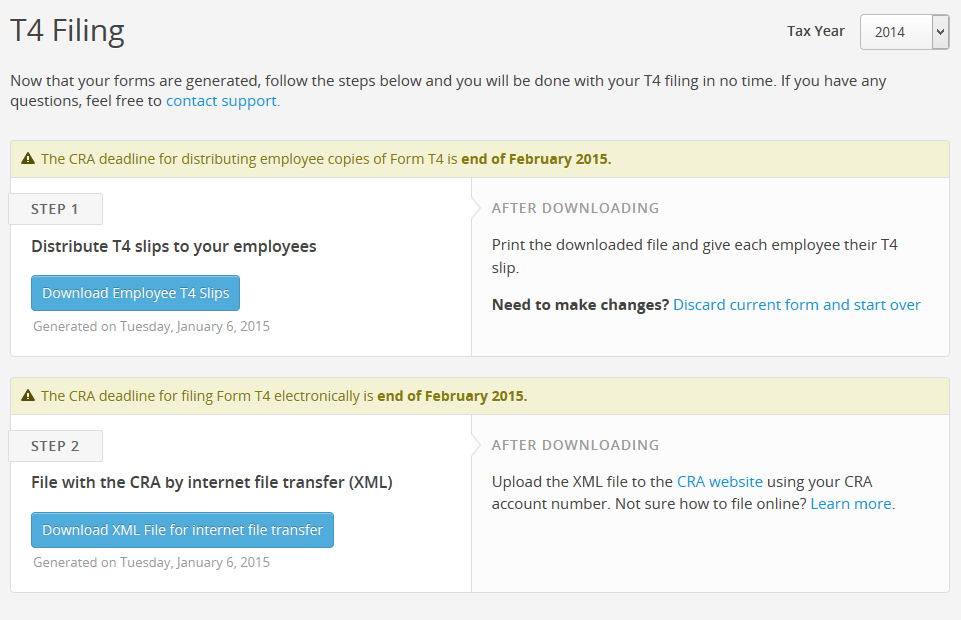

Our designers and developers have been working overtime to streamline T4 filing. See how easy it’ll be to file your T4s below:

This two-step process is simpler than ever. Once your employees have verified that their T4s are correct you can upload the XML file to the CRA (Canada Revenue Agency) site in a matter of minutes.

Not familiar with the year-end filing process? No worries, we’ve created a handy guide to help walk you through the process.

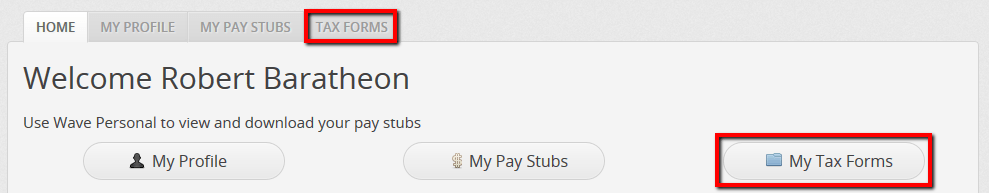

Still seem like a lot of paperwork? We’re also going to be making employees’ T4s available on their personal Wave account. This feature will be available by mid-January. Just make sure you’ve invited your employees to Wave from your payroll account. (They can also check their paystubs in this personal account!)

If you have any questions about this or anything else, please reach out to our Customer Support Heroes for help!

Not using Wave yet?

Wave’s free financial management software makes it easier to invoice clients, get paid, and manage your books. Simply visit waveapps.com, click on “Create your free account,” and enter your email. You’ll be up and running in seconds. Download a copy of Fearless Accounting with Wave to get started with confidence.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.