Payroll by Wave – Say Hello to the new Tax Liabilities Page

What is a payroll tax liability?

Every time you run a payroll a portion of it needs to be set aside to pay taxes to the state and federal government. This tax obligation will accumulate payroll to payroll, every once in a while you will need to make payments to the state or federal government as they come due. We’re now making it easier than ever to track these payroll tax liabilities.

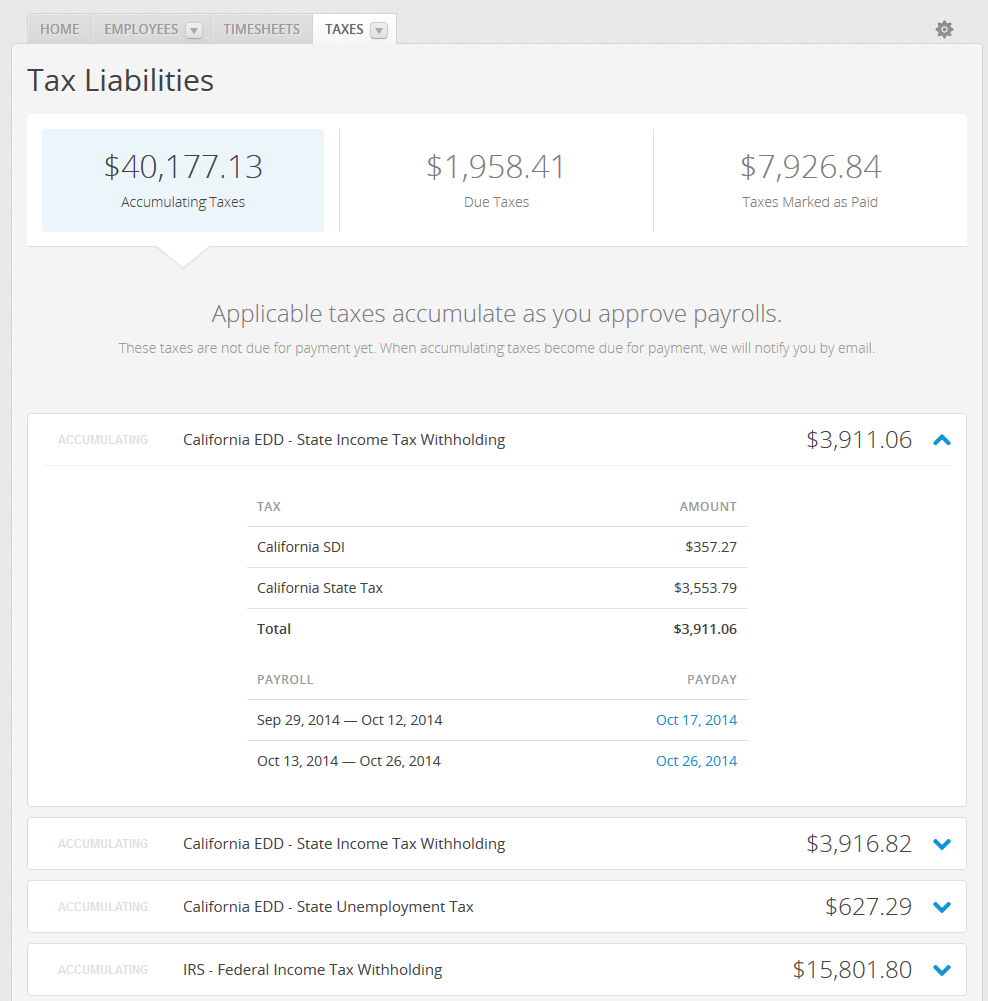

We’re pleased to announce that the payroll team has released a new Tax Liabilities page. The Tax Liabilities page makes it simpler than ever to track your outstanding payroll tax liabilities, when they’re due and to which department. The page also allows you to mark liabilities paid once you’ve done so, giving you the satisfaction of watching you due tax balance decrease before your eyes.

Why You’ll Love the New and Improved Tax Liabilities Page

- Easier than ever to know who to pay, how much, and when.

- Track liabilities that are coming due and mark them paid once you’ve done so.

- Automated email reminders for taxes that have come due, we’ll help you avoid penalties.

- Know how much you’ve paid in all individual payroll taxes over any period of time.

- Makes completing quarterly and year end forms a breeze.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.