T4 return tips for Canadian employers

It’s that time of year again— each Canadian business owner needs to report employee income and deductions to the government in the form of a T4 slip. You will need to fill out a T4 if you have deducted CPP, EI, PPIP premiums or income tax from your employee’s wages, or if their wages are more than $500.

T4 slips are due to your employees by February 28th. It only takes a couple of minutes to generate T4 slips for your employees in Wave. At this time, we do not file your T4 return on your behalf, but we do make it easy for you to do it yourself!

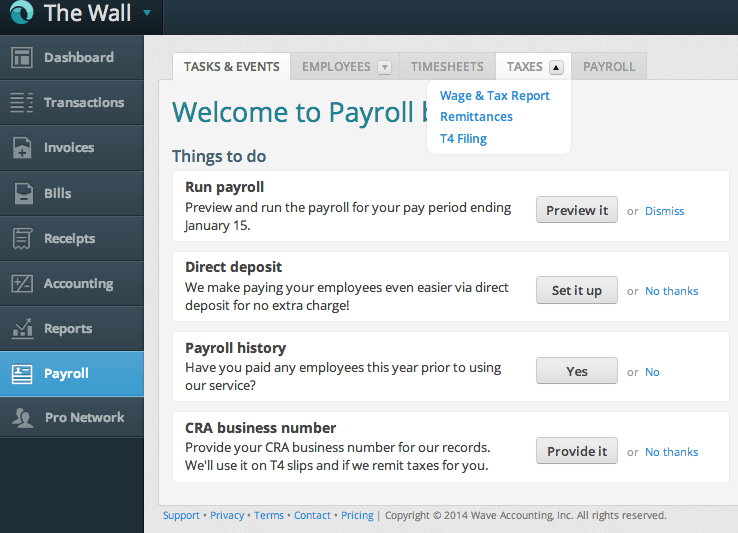

Simply select the Taxes tab and select T4 Filing:

From there you will be able to see T4 slips for each of your employees. Please take a look through these forms to ensure you are not missing any fields. Then, scroll to the bottom and select the green Generate T4s and T4 Summary button.

From here you will need to do two last things:

1. Print and distribute T4 slips to your employees before February 28th.

2. File your T4 return before the February 28th, 2014 deadline. To do this, you can file a paper return or an electronic return with the CRA. If you have any questions, check out the T4 section on the CRA website.

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for the first 10 transactions of each month of your subscription, then 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions for the US and Canada. See Wave’s Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.