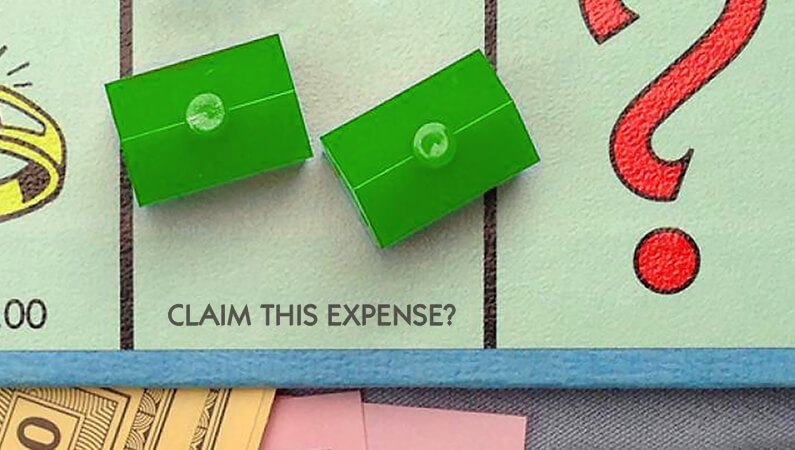

Tax Quiz: “Can I claim this?”

With tax season in full swing, it can be a real hassle for freelancers and small business operators to know what deductions you can claim and what you can’t. Is it a personal expense or is it maybe a business deduction?

So join us for a round of everyone’s favourite tax season game, “Can I Claim This?”

*While subscribed to Wave’s Pro Plan, get 2.9% + $0 (Visa, Mastercard, Discover) and 3.4% + $0 (Amex) per transaction for unlimited transactions during the offer period. After the offer ends: over 10 transactions per month at 2.9% + $0.60 (Visa, Mastercard, Discover) and 3.4% + $0.60 (Amex) per transaction. Discover processing is only available to US customers. See full terms and conditions.

See Terms of Service for more information.

The information and tips shared on this blog are meant to be used as learning and personal development tools as you launch, run and grow your business. While a good place to start, these articles should not take the place of personalized advice from professionals. As our lawyers would say: “All content on Wave’s blog is intended for informational purposes only. It should not be considered legal or financial advice.” Additionally, Wave is the legal copyright holder of all materials on the blog, and others cannot re-use or publish it without our written consent.